The Ministry of Corporate Affairs (MCA) recently levied an Rs. 4.54 lakh penalty on Sailor Exports Limited and its directors for failing to file Form DIR-12 on time, thereby violating Section 170(2) of the Companies Act, 2013.

The case revolves around Mrs. Sunita Nagrani’s appointment as a woman director on August 22, 2022. Despite the appointment, the corporation only submitted DIR-12 on April 19, 2023, well after the thirty-day deadline. This delay resulted in a violation of Section 170(2), and the corporation and its officers are now facing sanctions under Section 172.

The adjudicating officer, Mukesh Kumar Soni, evaluated the facts and circumstances, including the company’s response and the previous adjudication order. It was clarified that the infringement was related to Section 170(2) and was distinct from the previous Section 149(1) violation.

A show cause notice was given on November 30, 2023, with a response from the corporation on December 1, 2023. The company’s request to reconsider the previous adjudication order was denied, emphasising the unique nature of the current breach. Notices of inquiry were given out on December 6, 2023, with a hearing scheduled for December 19, 2023. However, no officials from the corporation arrived, therefore the case was handled ex parte.

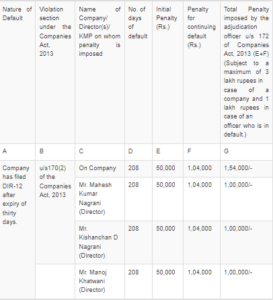

Penalty Provision: Noncompliance with Section 170(2) results in a penalty of Rs. 50,000, plus Rs. 500 for each day of continued failure, up to a maximum of Rs. 3 lakh for the firm and Rs. 1 lakh for each officer in default.

The entire penalty amounts for the corporation and its directors—Mahesh Kumar Nagrani, Kishan Chand Nagrani, and Manoj Khatwani—were computed based on the 208-day default period (22.09.2022 to 18.04.2023).

The adjudicating officer, Mukesh Kumar Soni, recommended that the company and its officers pay a total penalty of Rs. 1,54,000/- for the default period. Nonpayment may result in additional consequences, such as fines and jail. In the event of a dispute, the business and its executives may file an appeal within sixty days of receiving the order, using the procedures described in Sections 454(5) and 454(6) of the Companies Act of 2013.

This ruling, dated December 20, 2023, serves as an important reminder to businesses to follow legislative deadlines to avoid penalties and legal ramifications. The extensive research sheds light on the adjudication procedure and the specific concerns in this instance.

Office of The Registrar of Companies,

Madhya Pradesh

Sanjay Complex, ‘A’ Block, 3rd Floor,

Jayendraganj, Gwalior — 474009.

Email: roc.gwalior@mca.gov.in

Order No. ROC-G/Adj-

Penalties/Order/2023/2968

Dated 20 DEC 2023

Order for Penalty for Violation of Section

170(2) of the Companies Act, 2013

In the matter of Companies Act, 2013

And

In the matter of adjudication proceeding

under Sub-section (2) of section 170 of

the Companies Act, 2013.

And

In the matter of Sailor Exports Limited

The Ministry of Corporate Affairs appointed the undersigned as Adjudicating Officer (AO) in the exercise of the powers conferred by section 454(1) of the Companies Act, 2013 (hereinafter known as the Act) read with the Companies (Adjudication of Penalties) Rules, 2014 for adjudging penalties under the provisions of this Act in its Gazette Notification No. A-42011/112/2014-Ad.11, dated 24.03.2015. The undersigned has been appointed to adjudicate fines under Section 172 of the Companies Act, 2013.

Whereas, Company SAILOR EXPORTS LIMITED having GIN: U63021MP1995 PLC010258, (hereinafter referred to as “Company”) is a registered company with this office under the provisions of Companies Act, 1956 having its registered office situated at 179/3 Patthar Mundla Road, Palda, Indore, Madhya Pradesh, 452001, India, 1st Floor, 6/2, Nayta Mundla Road Nemawar Road Palda, Indore, Madhya Pradesh, 452020, India, as per the MCA21 Registry.

– Section 170:

1[ (1) Every company shall keep at its registered office a register containing such particulars of its Directors and key managerial personnel as may be prescribed, which shall include the details of securities held by each of them in the company or its holding, subsidiary, subsidiary of company’s holding company or associate companies.

[(2) A return containing such particulars and documents as may be prescribed, of the Directors and the key managerial personnel shall be filed with the Registrar within 2&3[thirty days] from the appointment of every director and key managerial personnel, as the case may be, and within thirty days of any change taking place.]

Mrs. Sunita Nagrani was appointed as a women director by the company’s shareholders on August 22, 2022, prior to the date of the auditor report, which is September 3, 2022. However, on April 19, 2023, the business filed DIR-12 under SRN AA2038179 for the appointment of Mrs. Sunita Nagrani, a woman director. As the corporation filed the form DIR – 12 after thirty days following the appointment of the female director. Thus, the company and its executives in default have violated the provisions of Section 170(2) of the Companies Act, 2013 and are subject to punitive action under Section 172 of the Companies Act, 2013.

The company’s response dated 01.12.2023 is inadequate because clauses 149(1) and 170(2) of the Act are not the same. In this case, the firm delayed filing Form DIR-12 under SRN AA2038179, i.e., after the expiry of 30 days after the appointment of a woman director on 22.08.2022, violating the provisions of section 170(2) of the Act and is liable for criminal action under section 172 of the Companies Act, 2013.

Non-compliance with section 170(2) would give rise to liability under section 172 which read as under

Section 172

If a company is in default in complying with any of the provisions of this Chapter and for which no specific penalty or punishment is provided therein, the company and every officer of the company who is in default shall be liable to a penalty of thousand, and in case of continuing failure, with a further penalty of five hundred rupees for each day during which such failure continues, subject to a maximum of three lakh rupees in case of a company and one lakh rupees in case of an officer who is in default.]

Having considered the facts and circumstances of the case and after taking into account the factors above and Notice dated 30.11.2023 and 06.12.2023 issued by ROC, Gwalior and submission submitted by the company it is concluded that the company and its officers in default are liable for penalty as prescribed under Section 172 of the Act for default is made in complying with the requirement of Section 170(2) of the Act. viz. SAILOR EXPORTS LIMITED. The term of default begins on September 22, 2022, i.e., after the expiration of 30 days after the appointment of women directors on August 22, 2022. The default period would continue until the filing of form DIR-12 under SRN AA2038179 on April 19, 2023. (This period is referred as the default period) Therefore, the default period is 208 days (from 22.09.2022 to 18.04.2023)

Thus, the penalty is calculated as follows: