In a recent order, the Ministry of Corporate Affairs (MCA) levied a penalty on BASIS VECTORS INDIA PRIVATE LIMITED for failing to file e-form MGT-6 within 414 days, as required by Section 89(6) of the Companies Act of 2013. The punishment also applies to the company’s directors, Ambarish Narayan Gupta and Deepak, for their involvement in the breach.

BASIS VECTORS INDIA PRIVATE LIMITED, formed on June 29, 2022 and based in Gurgaon, Haryana, was found to have violated Section 89 of the Companies Act, 2013. The company, which engaged in philanthropic operations, got non-compliance complaints, prompting an investigation by the Ministry of Corporate Affairs.

The corporation, according to the order, delayed filing e-form MGT-6 by 414 days. The breach was identified in the context of Sections 89(6) and 89(7) of the Companies Act of 2013.

The Adjudicating Officer, Pranay Chaturvedi, fined BASIS VECTORS INDIA PRIVATE LIMITED Rs. 4,14,000 for the delay in filing MGT-6. The penalty for directors Ambarish Narayan Gupta and Deepak has been fixed at Rs. 4,14,000 each. However, the penalty sum for each director was set at Rs. 2,00,000, as established by Section 89(7) of the Act.

The order requires the parties involved to pay the fines levied within 90 days of receiving the order. Payment is to be done through the MCA website, and proof of payment must be presented to the office.

Furthermore, parties aggrieved by the ruling may file an appeal with the Regional Director (NR), Ministry of Corporate Affairs, within sixty days of obtaining the order. The appeal must be made on the prescribed form available on the Ministry’s website, together with a certified copy of the order.

The penalty order against BASIS VECTORS INDIA PRIVATE LIMITED emphasises the importance of meeting regulatory obligations under the Companies Act, 2013. The MCA’s severe penalty enforcement acts as a reminder to corporations and directors to file essential forms and disclosures within the required time frames, encouraging transparency and accountability in corporate governance.

GOVERNMENT OF INDIA MINISTRY OF CORPORATE AFFAIRS

OFFICE OF REGISTRAR OF COMPANIES

NCT OF DELHI & HARYANA

4TH FLOOR, IFCI TOWER, 61, NEIIRU PLACE

NEW DELHI -110019

ORDER OF PENALTY PURSUANT TO SECTION 89 OF THE COMPANIES ACT, 2013 IN THE MATTER OF BASIS VECTORS INDIA PRIVATE LIMITED (U74999H R2022FTC104800)

The Ministry of Corporate Affairs appointed the Registrar of Companies, NCT of Delhi & Haryana as Adjudicating Officer on March 24, 2015, in the exercise of the powers conferred by Section 454(1) of the Companies Act, 2013 (hereinafter referred to as the Act) r/w the Companies (Adjudication of Penalties) Rules, 2014 for adjudging penalties under the provisions of this Act.

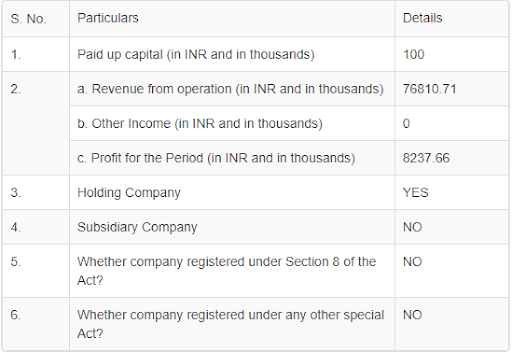

The company, BASIS VECTORS INDIA PRIVATE LIMITED (hereafter referred to as the ‘Company’), was incorporated on June 29, 2022, and its registered office is located at HD-084, WeWork DLF FORUM BUILDING, CYBER CITY, PHASE III, GURUGRAM, Gurgaon, Haryana,122002, India, according to the MCA21 Register. The financial and other details of the subject company for the year ended March 31, 2023, as published on the MCA-21 portal, are stated below:

(i) According to the records, the company submitted its Annual Return for Fiscal Year 2022-23 via eform MGT-7 (SRN F63882963), which states that BASIS VECTORS, INC. owns 100% of the subject company’s shares. However, it can be seen that the corporation has a total of two stockholders. As a result, the beneficial and registered holders of the shares should have declared their ownership status in accordance with Sections 89(1) and 89(2) of the Act. Furthermore, it was discovered that the company did not file MGT-6 in accordance with Rule 9 (3) of the Companies (Management and Administration) Rule, 2014 with this office.

(ii) In view of the aforesaid circumstances, a show cause notice under section 89 of the Act was given to the corporation on September 29, 2023.

(iii) In response to the aforementioned SCN, the corporation responded on October 12, 2023, stating that the e-form MGT-6 was filed on October 10, 2023, under SRN F66840828.

(iv) Furthermore, in light of the comments made in response, a hearing in the issue was scheduled for oral submissions on November 1, 2023, at which Ms. Preeti Bansal, Practising Company Secretary and Authorised Representative (AR) of the Company, appeared and stated as follows:

(v) Following the hearing, based on the submissions, the company was asked to submit further documents such as an authorization letter for MGT-5, proof of receipt of declarations under sections 89(1) and 89(2), and other papers.

(vi) Following that, the corporation submitted the requested information via a letter dated 03.11.2023 and a letter dated 21.11.2023, both received on 01.12.2023.

(vii) Thus, the files of form MGT-6 show that the corporation received forms MGT-4 and MGT-5 on July 23, 2022, while form MGT-6 was submitted with SRN F66840828 on October 10, 2023.

Section 89. Declaration in respect of beneficial interest in any share: