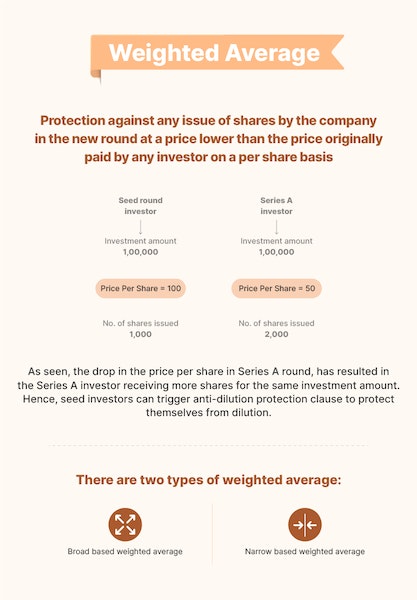

Weighted average is a calculation used for anti-dilution protection, when a down round occurs. It is used to adjust the value of the preference shares of existing shareholders to a new weighted average price, which will be the conversion price.

Common weighted average calculation methods are:

(a) broad- based weighted average and

(b) narrow- based weighted average.

In the broad-based weighted average method, all the outstanding (issued) shares, including convertible instruments (presumed to have been converted to equity) are considered on a fully diluted basis, whereas in the narrow-based weighted average method, only equity and preference shares that convert to equity are considered.