SAR refers to stock appreciation rights.

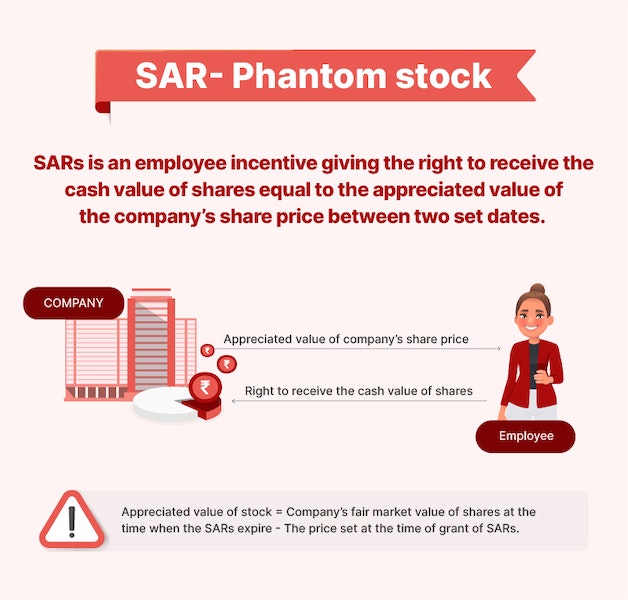

It is an employee incentive arrangement (a variation of the stock option plan) in which employees are paid an amount equivalent to the appreciated value of stock of the company. The appreciated value is the difference between the price of shares between the grant date and exercise date of the SAR.

A SAR is normally paid in cash, although it could also be settled in equivalent value of stock. Alternatively, a SAR could also be settled in a combination of cash and stock.

SARs do not represent actual equity – employees only enjoy the economic benefit of appreciation in the value of a specified number of shares that the company committed when the SARs were granted to the employee.