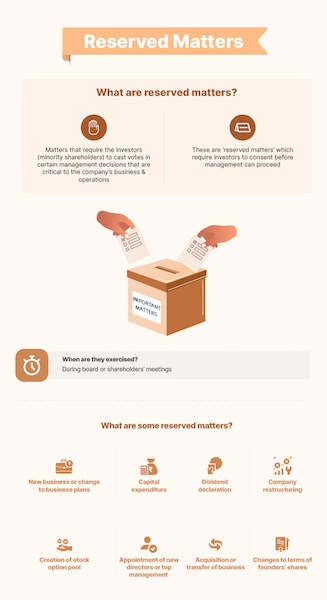

Investors need to protect the funds they have invested in a company. To do so, they need to exercise some control over its activities. This is why there are clauses in the shareholders agreement which restrict management from taking certain business and operational decisions, unless the investors vote in their favour. These are called the investors’ ‘affirmative voting rights’. These protect investors and prevent any management action.

Affirmative voting rights are important because investors are usually minority shareholders in a company and the majority has the shareholding percentage to push through certain decisions despite the investors’ objections. So, a contractual obligation to get the investors’ affirmative votes on certain ‘reserved matters’ is needed.