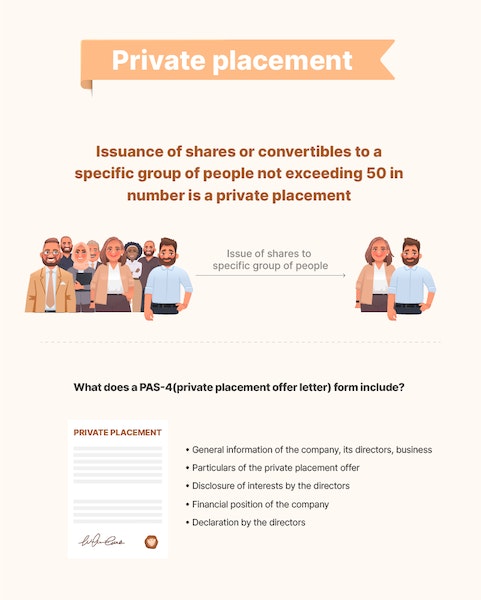

Private placement is the offer of securities to a selected group of persons other than by public offer. The offer is made through a private placement letter. The offer letter for subscription (in Form PAS-4) is sent to a maximum of 50 selected individuals excluding the employees of the company and qualified institutional buyers. All details of the private placement are maintained in Form PAS-5.

A few key points to note are:

1. A separate bank account has to be maintained to deal with the subscription money received towards private placement and other related transactions.

2. Investors can subscribe to shares only through cheque, demand drafts, or other banking channels, and not through cash.