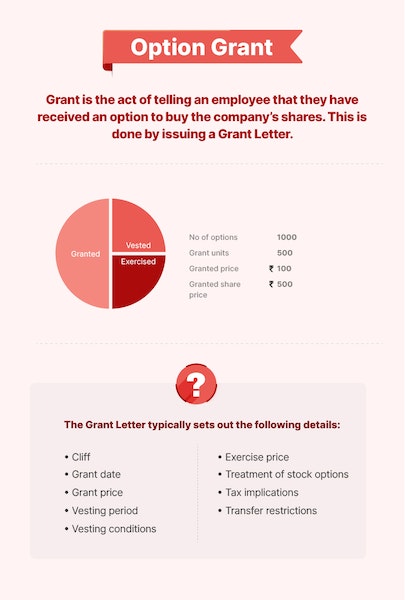

Awarding stock options to employees is called a ‘grant’. All the terms of the grant must be captured in the grant letter, such as the number of options being granted, cliff period, grant date, grant price, vesting period, vesting conditions, exercise price, exercise period, tax implications, restrictions on transfer, and so on.