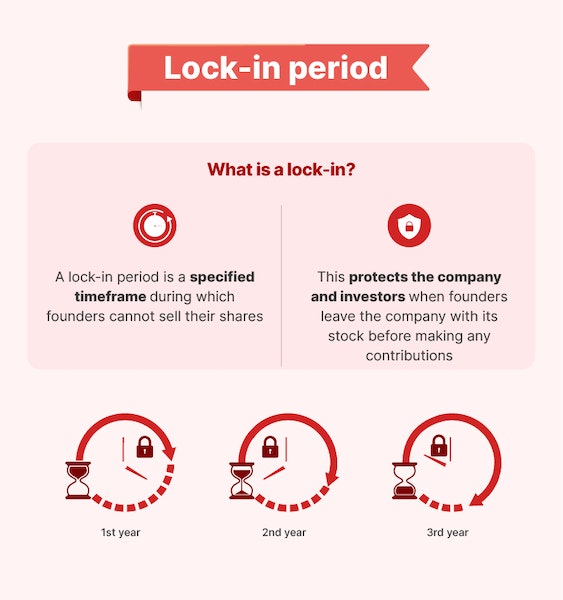

Lock-in period usually refers to a duration when certain actions are restricted. In the context of start-ups and founders’ commitments to investors, it’s seen that investors usually insist that the ability of founders to sell their shareholding in the company is restricted for a specified duration. With each new round of funding, however, founders can request for a higher amount of liquidity. Later-stage investors are often more comfortable providing liquidity to founders.