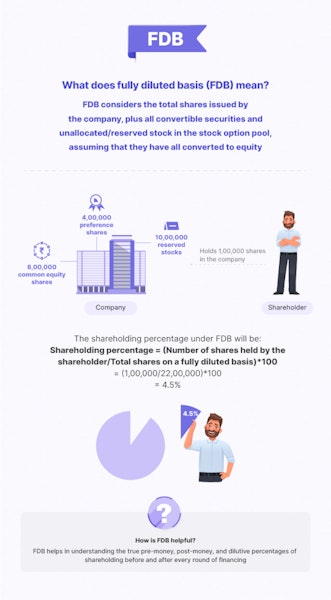

FDB refers to ‘fully diluted basis’. Under FDB all shares considered to be issued including convertible instruments, options are assumed to have converted to equity shares. This assumption helps in determining the true percentage of holding of each shareholder, whether founder, angel, or investor.

Using the FDB concept, the precise holding of each shareholder is calculated, by dividing the number of shares each shareholder owns by the total shares issued by the company.

As a term, FDB is most often used in shareholders agreements, share subscription agreements, and term sheets. It gives the true shareholding percentage of an investor, and helps in understanding pre-money, post-money, and dilutive percentages of shareholding before and after every round of financing.