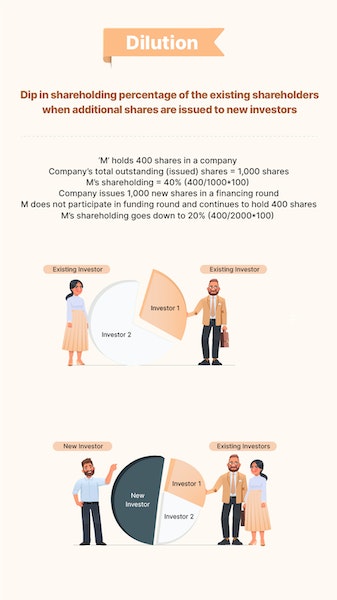

When a company issues new shares to new investors, the shareholding percentage of existing shareholders reduces – this is called dilution of their shareholding.

Every time shares are issued to a new investor, the shareholding of existing shareholders dilutes, even if they participate in the new round.

Essentially, although the pie increases (more shares issued), because there are more takers (incoming investor), the number of slices increases (investor + existing shareholders) while the size of the slice reduces for each of them.