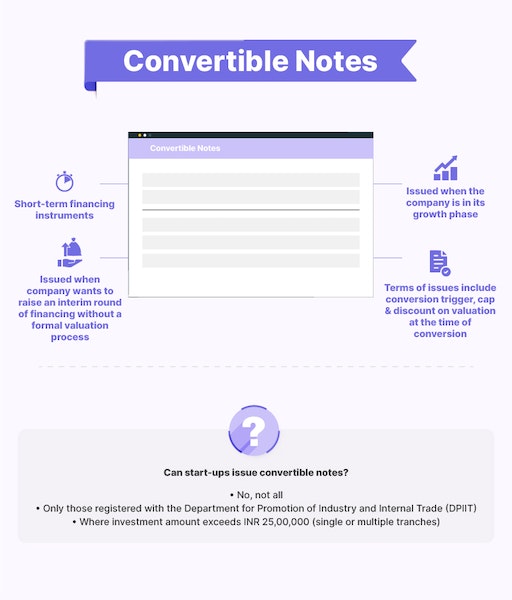

Convertible notes are short-term financing instruments that are issued when the company wants to raise an interim round of financing. They are issued with an option for conversion to equity in the future. Usually, notes convert to equity based on a trigger event. This could be a future round of financing, operation metrics, pure passage of time or at the discretion of the company.

Typically, the terms of issue of convertible notes cover aspects such as:

a. Details of conversion parameters

b. Rate of interest and type

c. Term (duration) of note