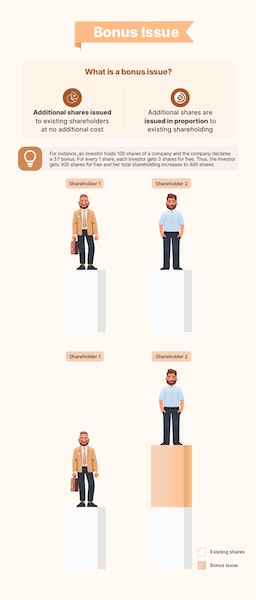

When additional shares are issued to a company’s shareholders, free of cost, it’s called a bonus issue. Shares are issued from the accumulated profits of the company in proportion to the shares held by shareholders as on date.

Companies issue bonus shares to encourage retail participation and increase their equity base. When the price per share of a company is high, it becomes difficult for new investors to buy them. Bonus shares increase the number of shares and lower the price per share. This provides liquidity to shareholders. The overall capital remains the same however even when bonus shares are declared.

Sometimes, companies also issue bonus shares when they are not able to pay dividends due to shortage of funds.