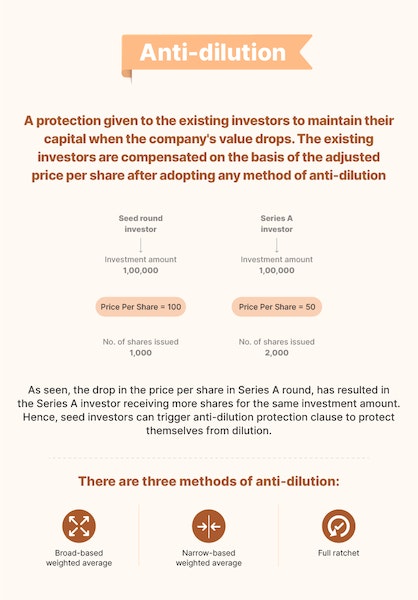

Anti-dilution or valuation protection rights is a protection given to the shareholders of the company to protect them from the down round.

In any future round, if the company issues shares at a price lesser than the price originally paid by the investors in the previous round for the same class of shares, it results in a dilutive issuance of additional equity shares to the new investors which is unfair to the existing shareholders. Accordingly, in a down-round, the existing investors benefit in the form of an increased ownership in the company, by way of an adjustment to the conversion price or conversion ratio of the convertible securities held by them.