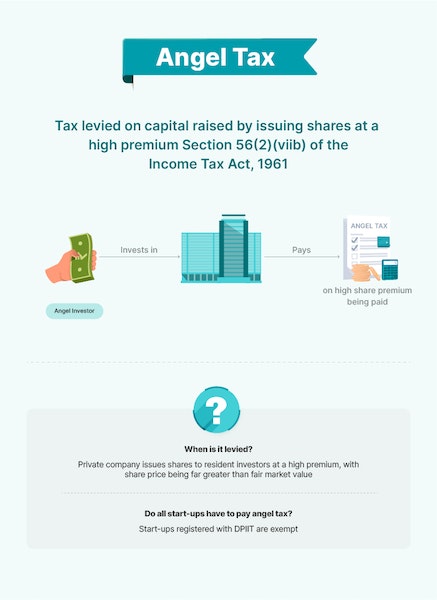

Angel tax is tax charged on private companies when they raise capital by issuing shares to resident investors at a price higher than the face value and fair market value of the shares.

Section 56(2)(viib) of the Income Tax Act, which levies this tax, was introduced to prevent a form of money laundering by taxing private companies that were issuing shares at an excessive premium (over and above the fair market value) as a means of accounting for money that was previously unaccounted on their books.

Start-up companies often raise funds from angel investors at a high premium, so does every start-up that raises capital have to pay this tax? No, not all, because start-ups registered with the Department for Promotion of Industry and Internal Trade (DPIIT) are exempt from paying angel tax.