Investors need to protect the funds they have invested in a company. To do so, they need to exercise some control over its activities, especially if they involve expansion of operations, capital expenditure, change in ownership, new investments, or changes to business plans.

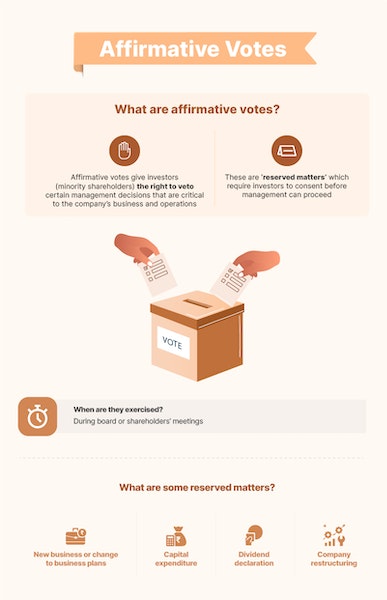

In shareholders’ agreements, which investors sign with the company and its founders, there are clauses which restrict management from taking certain business and operational decisions unless the investors vote in their favour. These are called the investors’ ‘affirmative voting rights’, which can be exercised in board or shareholders’ meetings. These protect investors and prevent any management action that could be detrimental to their interests.

Affirmative voting rights are important because investors are usually minority shareholders in a company and the majority has the shareholding percentage to push through certain decisions despite the investors’ objections. So, a contractual obligation to get the investors’ affirmative votes on certain ‘reserved matters’ is needed.

These rights, also called ‘veto rights’, are typically exercised in critical matters such as amendments to a company’s charter documents, declaration of dividend, issue of new shares, appointment and removal of auditors, change of company’s name or registered office, disposal of company’s assets, investments in other entities, capital expenditure, acquisition of other businesses, transfer of business, company’s dissolution, corporate restructuring, and so on.